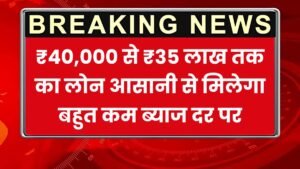

If you want to grow your small business or start a new one you need money. Sometimes it is not easy to get enough money Banks can help. In India many big banks give loans for business. You just need to choose the right bank for your need. A business loan can help you make your dream big.

State Bank of India (SBI)

SBI is a very big bank Everyone knows about it This bank gives loans to small and big businesses. If you need money for a small business SBI is a good choice. It has a special loan called Mudra loan. This loan does not need any security. That means you do not need to keep anything as a guarantee. SBI loans have low interest. So your monthly payment will not be high. This is why many people like SBI loans.

HDFC Bank

HDFC Bank is fast in giving loans. If you need money quickly this bank can help you. HDFC does not ask for too many papers It is easy to apply They also give loans based on your business need. This is called customized loans. This is good for small businesses that want to grow.

ICICI Bank

ICICI Bank is good for medium and big businesses. This bank has many types of loans. It gives working capital loans, term loans, and more. You can apply for a loan online. It is very easy and saves time. You do not need to go to the bank. The interest rate is not very high. The process is also quick.

Axis Bank

Axis Bank is good for new business owners. If you are a woman and want to start a business this bank can help you. It has special loans for women. These loans are easy to get and have good benefits. Axis Bank is also good for people who are starting their first business. It helps them get money without too much trouble.

Bank of Baroda

Bank of Baroda is best for small and medium businesses. It is good for startups. If you are new in business, this bank can support you. It gives loans with low interest. The process is simple. You do not need to worry about many rules. This is why it is a popular choice for new businesses.

How to Choose the Right Bank

Choosing the right bank is important. First, you need to know how much money you need. Then, check how you will repay the loan. Always read all the rules before you apply. Some banks have hidden charges. You need to check for those. Pick a bank that has simple rules and low interest.

Why Business Loans Are Important

A business loan can give you the money you need to grow. It helps you buy new machines, hire more people, or open a new office. If you do not have enough money, a loan is the best way to solve the problem. But you must use the money wisely.

नमस्ते मेरा नाम Ravindra Singh है। मुझे कंटेंट राइटिंग के क्षेत्र में 4 साल का अनुभव है। पिछले एक साल से इस वेबसाइट पर अपनी सेवा दे रहा हूँ। मैं बैंक, फाइनेंस, लोन, स्कीम, SIP से सम्बंधित जानकारी आसान भाषा में समझाता हूँ। लोगो को सही जानकारी पहुँचाना ही मेरा उद्देश्य है।